A different point of view on investing, markets, and life.

By asking the right questions, we uncover better answers.

Together, we'll reconnect you to what matters most and create a tailored wealth plan that empowers you to take control of your financial affairs, giving you the confidence that you’re

on the right path.

The Bear Market Has Finally Arrived

With a deafening roar, the US stock market ran headlong into bear territory, the S&P sinking 20% below a January peak and hitting its lowest mark since the previous January. This was on the back of US inflation data coming in higher than expected - well, that's my take anyway. The ASX has opened down almost 5% making up for a closed day yesterday. Technology shares have been leading the declines, with the Nasdaq 100 slumping about 4.5%.

Here's Which Stocks Are Soaring

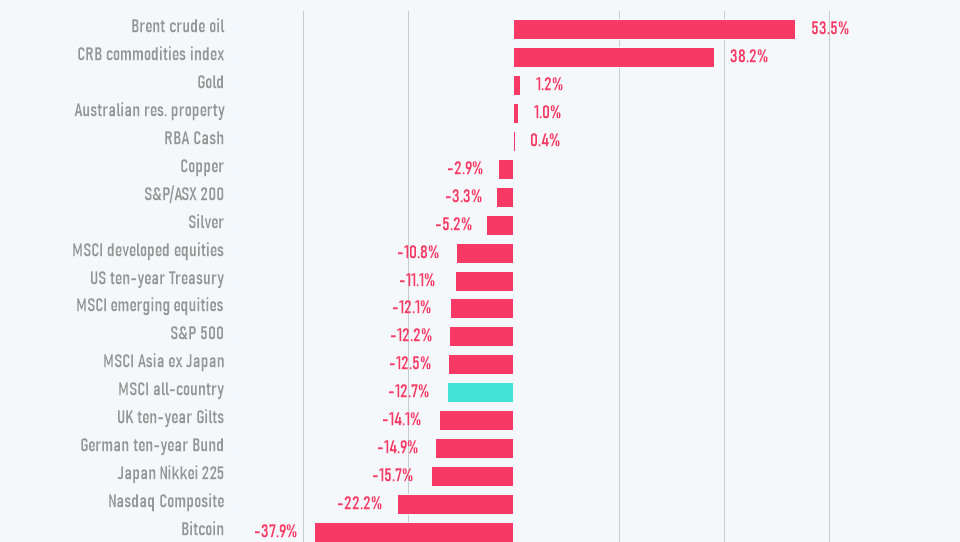

Last week I wrote about Everything is Getting Crushed where I looked at all the major assets classes to see how they were performing so far in 2022. We saw that everything but Oil and Commodities were getting crushed.

Everything is Getting Crushed

There has been absolutely nowhere to hide in financial markets in 2022. Stocks and bonds are getting crushed in the face of rising rates.

Australian Elections & Stocks

We hear it each and every time - the uncertainty surrounding the election. Of course it's uncertain. That's what the future is - uncertain. If anything was certain we would not be compensated or rewarded for risk.

To Fix or Not to Fix

It was 2007. I was working at one of the major private banks in their wealth management arm. I decided to fix my mortgage. Why wouldn't I? The RBA cash rate was about 6.25%, the economy was booming, and rates were only going to go higher. I was working in the industry, I would know what's going on. I fixed my mortgage in at 7.50% for 3 years. It was June of 2007 to be precise. Little did I know of the hairline cracks that were appearing in the global economy. Rates continued to climb for 1 full year subsequently and hit 7.25% in April of 2008. In fact, variable rates at this time were 9.44%. Fixed rates at that time were 8.97%. Look at me. I was a genius. Well above the average investor.

A Bloodbath

Even the market commentators have given up - "I've stopped looking". Is that what it's going to take? A bloodbath? When it gets all too hard, you give up? Just like that? Isn't this the time when you do your best work? Or will you tell us what we should have done after the fact? I'm genuinely curious. No, actually I'm not. I already know the answer. The question is rhetorical.

Ready to grow your wealth?

Let's talk. One call. No risk. Just a way to see if we're a good fit.